The truth is unavoidable: Social Security is

insolvent. It’s set to run out of money to pay scheduled benefits in about 15

years, barring action from Congress.

Policymakers have only a handful of options to avoid a

roughly 25% cut in benefits for everyone. They can raise taxes, cut benefits,

or enact a combination of both—and the sooner Congress acts, the smaller the

required tax increases or benefit cuts will be.

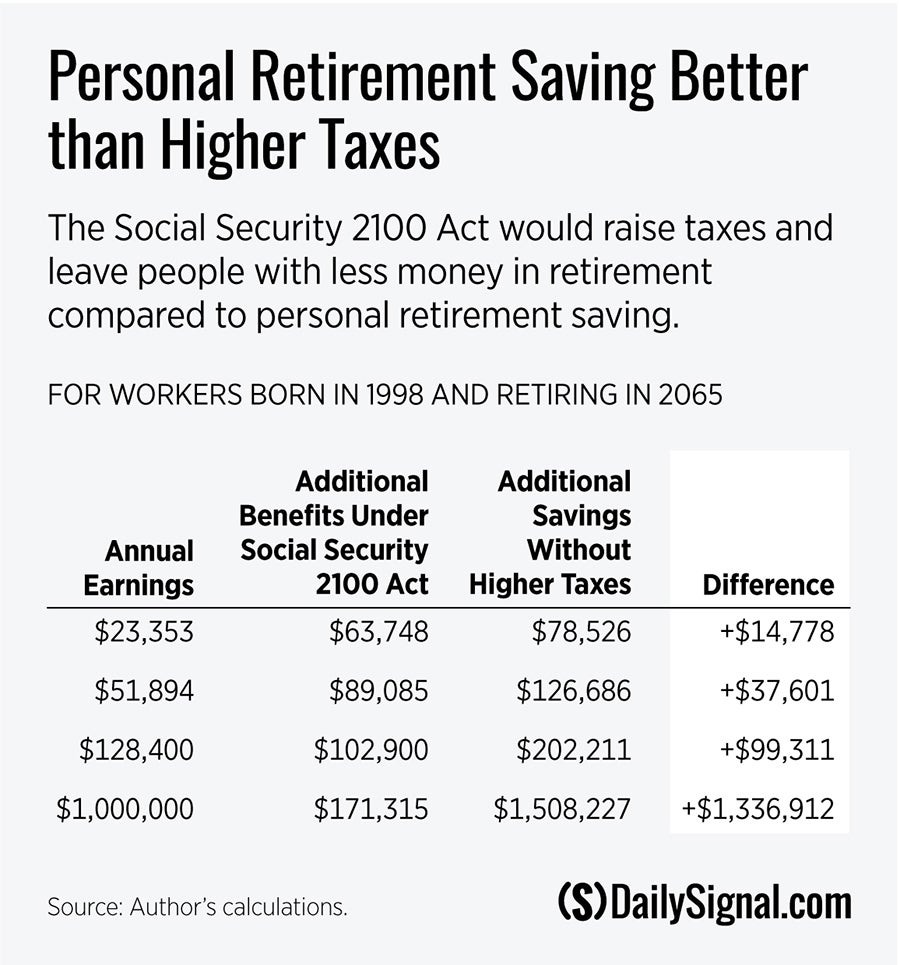

What’s not clear to many Americans is whether they

would be better off with a smaller or larger Social Security system altogether.

Would they be better off paying more in taxes and receiving more from Social

Security, or keeping more of their money in the first place?

In a new

report, my

colleague and I at The Heritage Foundation examine that question. We find that Americans

of all income levels would be better off paying less in Social Security taxes

and receiving more targeted benefits in line with need.

Alas, that’s not what Congress wants to do.

Within the next month or so, the House of

Representatives will likely pass the Social

Security 2100 Act, which would

make Social Security solvent by imposing super-sized tax increases.

The bill goes further than just raising taxes enough

to avoid benefit cuts. It would raise taxes enough to increase benefits immediately

for all current and future Social Security recipients.

Were the bill to pass, Social Security tax rates would rise for everyone beginning in 2020, rising incrementally from the current 12.4% to 14.8% in 2043.

Once fully phased in, someone making $50,000 a year would have to pay $1,200 more per year than what they’re paying today. Their total Social Security tax bill would be $7,400—about as much as an entire household spends on food in a year.

What’s most perplexing about the Social Security 2100 Act is that it would increase benefits the most for wealthy Americans.

Under …read more

From:: Daily Signal – Feed